Choose Language

BILBoard April 2020 – The storm before the calm

In last month’s BILBoard, we presented our revised base case scenario

for 2020 in light of the coronavirus crisis. In a nutshell, we see a deep,

government-induced recession spanning Q2, and most likely encroaching into Q3.

Thereafter, under a torrential downpour of government and central bank stimulus

and with a gradual easing of movement restrictions, economies should begin to

stabilise. Such a base case naturally carries an air of caution, given the unprecedented

nature of the crisis.

Macro: Into Q2 and into the abyss

While governments contemplate how to reopen their economies, much of the

global population remains under lock and key. The full, undiluted impact of

this is about to start showing up in macroeconomic data, and we expect to see the

speed of the deterioration peak in May. Already, the fragmented picture we have

is bleak. PMIs have tanked, displaying the devastating impact on demand and

activity, particularly in the Service sector with tourism and leisure off the

cards for the foreseeable future. Until now, the decline in consumption had been

cushioned by grocery store shopping and panic buying - this will probably peter

out and the true severity of the demand shock will become clear in upcoming

data releases.

Determining how bad it

will get is a shot in the dark, given the lack of comparable events in history

– Professor Yossi Sheffi

from MIT calls this the “Anna

Karenina principle”, paraphrasing Tolstoy; while happy economies are all alike,

every unhappy economy is unhappy in its own way. Looking at the current

environment, with a simultaneous shock to supply and demand, liquidity tensions

and a health crisis, we could borrow empirical examples from the Spanish flu,

the Great Depression, 2008 or even China’s experience with coronavirus, but the

utility of such a model would be limited, given the disparities in the social,

economic, technological and political contexts. No two disruptions are the

same, each comes with its own cascade of effects, meaning that we face “known

unknowns” and “unknown unknowns” – and the latter could render any attempt at

forecasting futile.

With government and central bank support bordering on the brink of “unconditional”,

the main “known unknowns” are behavioural and epidemiological. A

post-quarantine economic renaissance hinges on the behaviour of consumers and

businesses. Will consumer demand snap back? We expect to see some inertia in

the data, given that lockdown measures will be eased gradually to stave off a

second wave of infections. Moreover, consumption will be hit by rising

unemployment. Despite fiscal attempts to curtail layoffs (e.g. the US CARES Act

or the EU’s SURE program), businesses are letting staff go. 26 million

Americans have filed jobless claims (this will put dynamite under the

unemployment rate for April due to be published on May 8th). Whether they will

re-hire staff they let go is yet to be seen.

On the epidemiological front, the key unknowns include any potential

reacceleration in the number of new cases, testing efficiency and deployment,

and finally the time-to-vaccine and widespread treatment. Looking at the “known

unknowns” and base effects alone, we don’t expect GDP to recover its December

2019 levels before 2022.

Equities

Though looking into Q2 is like looking into a black hole, equity prices

seem to have skipped past the looming uncertainty and already seem to have a

V-shaped recovery in mind. The recent rebound of around 25% seems to be driven

by a combination of speculation, hopes and tweets rather than something more

tangible and, though we argued previously that markets will rebound long before

the economy, the pick-up is perhaps a bit premature.

At the same time, analysts are rapidly downgrading earnings expectations

in the opposite direction to prices, leaving valuations a bit stretched (we are

now at levels seen in February, before the crisis snowballed). The earnings

season itself is unlikely to be a game changer, with companies omitting future

guidance. With such uncertainty, we would be surprised if volatility didn’t

flare up again.

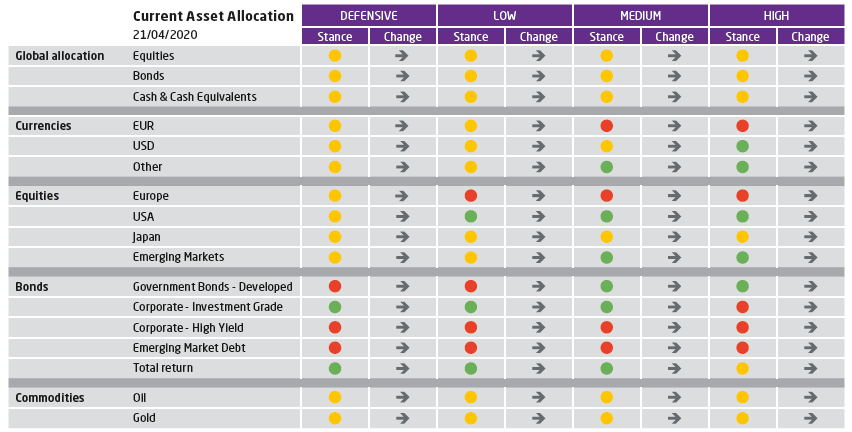

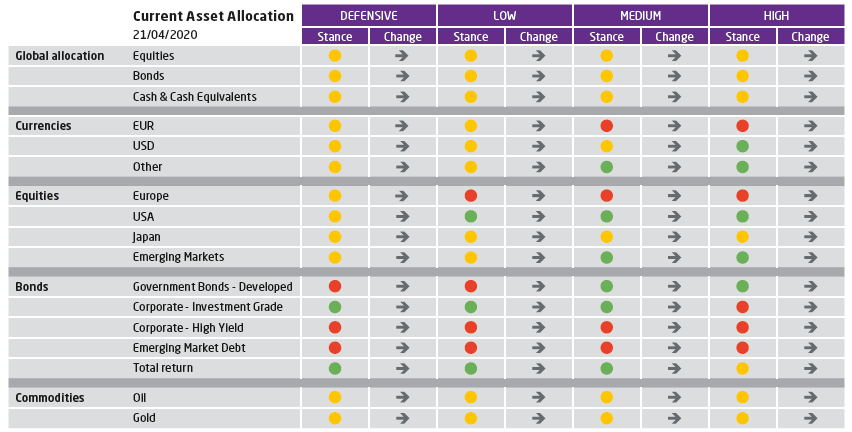

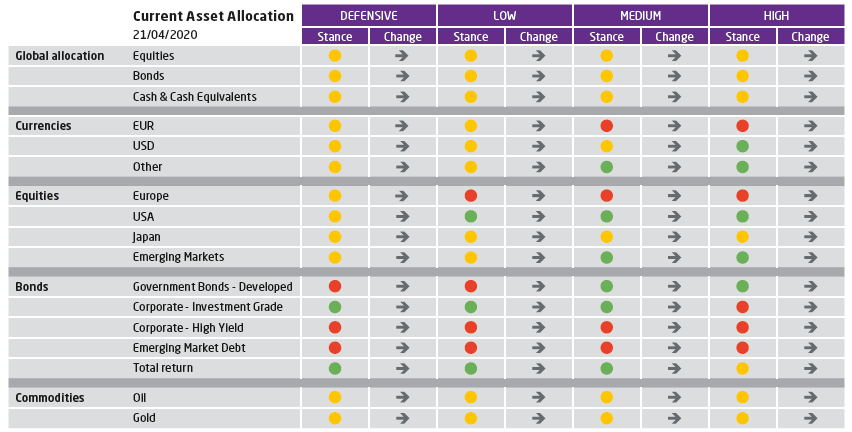

Until we have more clarity, we’re maintaining our neutral equity

positioning, content with the basket of hand-picked quality names added to our

portfolios before Easter (including well-capitalised firms with strong balance

sheets and low leverage, poised to weather the Q2 storm). In terms of regions, we

remain US-centric, where there are more secular growth stories, as opposed to

Europe which is more of a value play. We are also maintaining a very small

overweight to Emerging Markets (primarily China, which is now setting its

economy back in motion after getting the pandemic under control).

Fixed Income

Fixed income assets of all stripes are receiving central bank support,

whether direct or indirect. Renewed commitments from the ECB and the Fed to

credit were a game changer in markets – investors have returned en masse and

the new issue market is alive and kicking again. Both of these central banks are

vacuuming up corporate bonds, even “fallen angels” – investment grade names

that have been downgraded to junk.

In the government bond space, volatility has normalised but investors

are still weighing up the prospects of higher issuance against growing budget

deficits. This highlights the growing need to be active in the sovereign debt

market; we have already tweaked the layer of government bonds we hold to buffer

against equity risk, moving out of peripheral European govies to European Core

govies, with benchmark duration. We also have a selection of inflation-linked

bonds which will be helpful if fears about government spending with monetary

financing intensify.

We remain overweight on investment grade (IG) bonds – with central banks

having stemmed the March bleeding, quality corporate paper now offers a solid

investment case. After rotating towards US Treasuries last month, we are now doing

the same inside our corporate exposure, switching up European credits for the

US equivalent, in that approximately 20% of our overall allocation to credit is

now in USD IG (EUR-hedged). While the European credit market is undoubtedly

being cradled by the ECB, the Fed’s support is even stronger, with the central

bank going as far as to buy high-yield ETFs. As a result of this caretaker role

by the Fed, total return for US IG has turned positive year-to-date, while the

retracement in EUR IG spreads has been more timid.

Despite the fact that central banks are entering the upper echelons of the high-yield markets on both sides of the Atlantic (the ECB is not directly buying fallen angels, but those bonds can now be posted as collateral on repo operations), we are still steering clear of this segment, believing that risk is inadequately rewarded. Likewise, we are reluctant on Emerging Market debt. The rationale behind both of these stances is the fact that the oil price is at record lows, with futures prices even having turned momentarily negative. Energy firms make up a large proportion of the US HY market, and oil is a key export for many EM regions.

All in all, be under no illusions: we aren’t out of the woods yet. April showers are said to bring May flowers, but the slate of ominous data from this month will probably pale in comparison to what lies ahead. To navigate this tumultuous investment landscape, we must be unhurried, contemplative and logical, keeping our eyes on long-term investment objectives. To borrow from Tolstoy once again – “The strongest warriors of all are these two – time and patience”.

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...