April 22, 2024

BilboardBILBoard May 2024 – Rate cut reality check

The past month has brought a string of stronger-than-expected data from the US, further corroborating the idea of a no-landing scenario. The labour market is robust, with 303k jobs added in March – the most in 10 months – and 8.76 million jobs still open. This ongoing resilience raises some red flags for the trajectory of inflation, as it could prevent further softening in wage growth, which in turn, is feeding into services inflation (given the labour-intensive nature of this sector). Demand is also proving resilient: after a slight post-holiday pullback in January, US consumers are spending again, with retail sales blowing past estimates in March (+4% YoY).

For now, it’s clear that the inflation genie is not yet back inside the bottle. Headline CPI rose throughout Q1, reaching 3.5% in March, with oh-so-sticky services inflation still elevated at 5.4%. Rising commodity costs might also drive inflation in the months ahead.

If activity and inflation remain too strong, the risk is that the Fed will have to adopt a more hawkish stance and its policy pathway is now less certain. Recent comments from Fed officials imply they are willing to keep rates higher for longer if necessary.

The market is listening. While it expected six or seven US rate cuts in 2024 at the beginning of the year, it now expects just one or two beginning in September. In our view, we think that’s too close to the Presidential election, and that the Fed might still deliver a cut in July. While its official dot-plot currently indicates three cuts for this year, the risk is rising that this is revised to two. Much depends on incoming macro data over the next months.

On this side of the Atlantic, the Eurozone economy is showing signs of stabilising, albeit at low levels. Recession fears are receding, and the bloc came out of the winter with record high gas storage levels in a sign that it is moving past the energy crisis that has overshadowed it for more than two years. The WTO projects that global goods trade will return to growth this year, which should provide Europe’s export-oriented economy with some tailwinds. Other potential tailwinds may come from a gradual consumption rebound through 2024, and from fiscal spending (as at the end of 2023, only 30% of the EUR 800bn recovery fund had been disbursed). Overall, however, the reality is that Eurozone activity is weak and not much is expected in terms of a pick-up in 2024 (the ECB has revised its full-year GDP growth projection down to just 0.6%).

With regard to monetary policy, the Eurozone is clearly in greater need of easing than the US. Inflation is coming down more convincingly (reaching 2.4% YoY March). The real estate sector is under intense pressure, corporate loan demand declined substantially in Q1, which could lead to a slowdown in investment, and much of the upturn we have seen in leading indicators is due to optimism that respite in the form of lower rates is on the horizon.

We therefore believe the ECB could take the lead in lowering rates, beginning in June. Thereafter, if the Fed remains on hold, the ECB might have less room to manoeuvre… Lowering rates too much relative to the US would put downwards pressure on the euro and risk rekindling inflation (especially considering Europe’s dependence on global energy markets, where prices are denominated in US dollars).

Rising uncertainty about monetary policy has been accompanied by an uptick in geopolitical uncertainty. We are closely monitoring the situation between Iran and Israel. For now, the risk of a full-blown regional crisis seems contained, but the situation is fragile, and we stand ready to adjust our positioning if necessary.

Investment Strategy

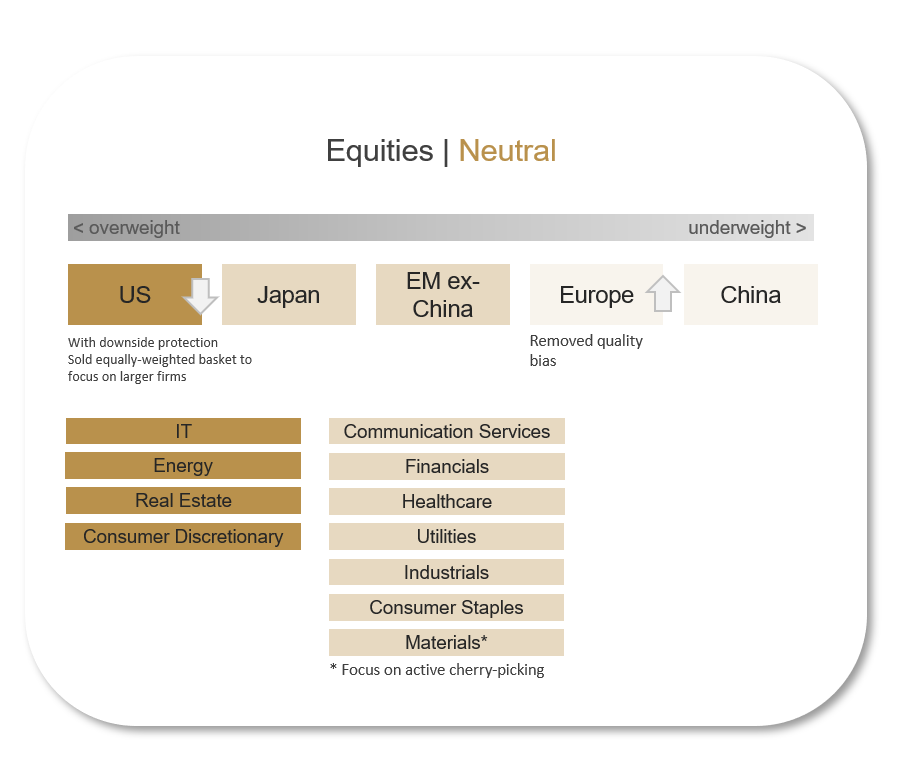

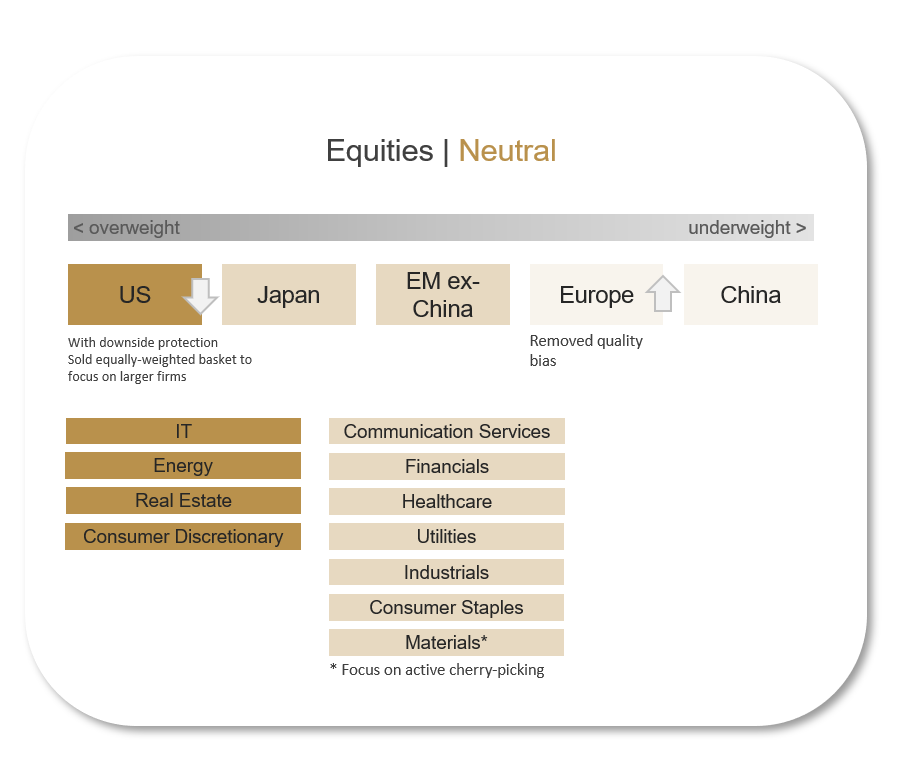

Broadly speaking, we have a neutral stance on equities (with a proportionately larger allocation in High risk profiles). After a blistering start to the year, some caution has crept into stock markets. While a further uptick in bond yields could create a stumbling block in the short-term, equities are still supported by global economic resilience, which should keep earnings supported, and the fact that while the Fed put might be delayed, it is not off the table.

Our largest regional overweight remains to be the US, though we have trimmed that exposure slightly. In January and February, less than 40% of firms on the S&P 500 were outperforming the index as a whole. In March, gains broadened out beyond Big Tech, and that percentage rose to 60%. By selling our equally weighted US equity basket, we lock in some of the gains and refocus on larger US firms with relative earnings security and ample cash (meaning they are better poised to wait out higher-for-longer monetary policy).

Underpinning this decision is the fact that while US macro data is undoubtedly strong, the rising economy is not lifting all boats: larger firms are faring well, but smaller firms less so (e.g., NFIB Small Business Optimism has fallen to its lowest level since 2012). Analysts expect profits for the seven largest growth companies on the S&P 500 to rise 37% in Q1 2024. When excluding them, profits on the index are anticipated to shrink by 3%.

The proceeds were used to decrease our underweight to Europe, where we have more clarity on the ECB’s policy path, and where data appears to be bottoming out. We also felt confident enough to remove the quality bias in our European allocation.

Sector-wise, we continue to focus on Energy as a geopolitical hedge. We also like IT, Consumer Discretionary and Real Estate.

*Positioning based on a Medium risk portfolio

In the fixed income space, the resurgence of the higher-for-longer narrative has inflicted some pain. We remain neutral on duration for the time being given the strength of the US economy. In the Sovereign market, we see Europe as more attractive in that it has sold off in sympathy with US rates: softer domestic fundamentals should keep rate increases contained.

We are most comfortable holding investment grade corporates (in Europe, where we see better value). Spreads are tight but we don’t see any real catalyst for material spread widening in the near-term. In high-yield, we give preference to the US, where the macro picture is more sturdy and where maturity walls are less of a concern. While valuations are indeed stretched, incremental yield should drive performance and positive momentum could continue.

The outlook for gold has grown more constructive, but with prices toppish, it might make sense to hold off for a more opportune entry point.

Conclusion

As domestic drivers take over from global trends in determining inflation outlooks, the years-long synchronisation among developed market central banks is weakening. Markets, which originally expected neat and tidy rate cuts beginning in summer, with the Fed and the ECB driving side-by-side, have had a reality check, with strong US data muddying that conclusion.

The last mile to 2% inflation targets will not be on a Luxembourg-style, smooth-surfaced highway. It will be akin to driving offroad on bumpy terrain with limited visibility. Incoming macroeconomic data will provide markets with vital direction over the next weeks, while the Fed’s refreshed dot-plot and economic projections (due out on May 1st), will serve as a more formal road sign.

As we await more clarity on whether the Fed will start to lower rates this summer, the good news is that markets appear to be warming to the idea that if we have higher rates for a little longer, it should be OK, as long as companies can produce decent earnings.

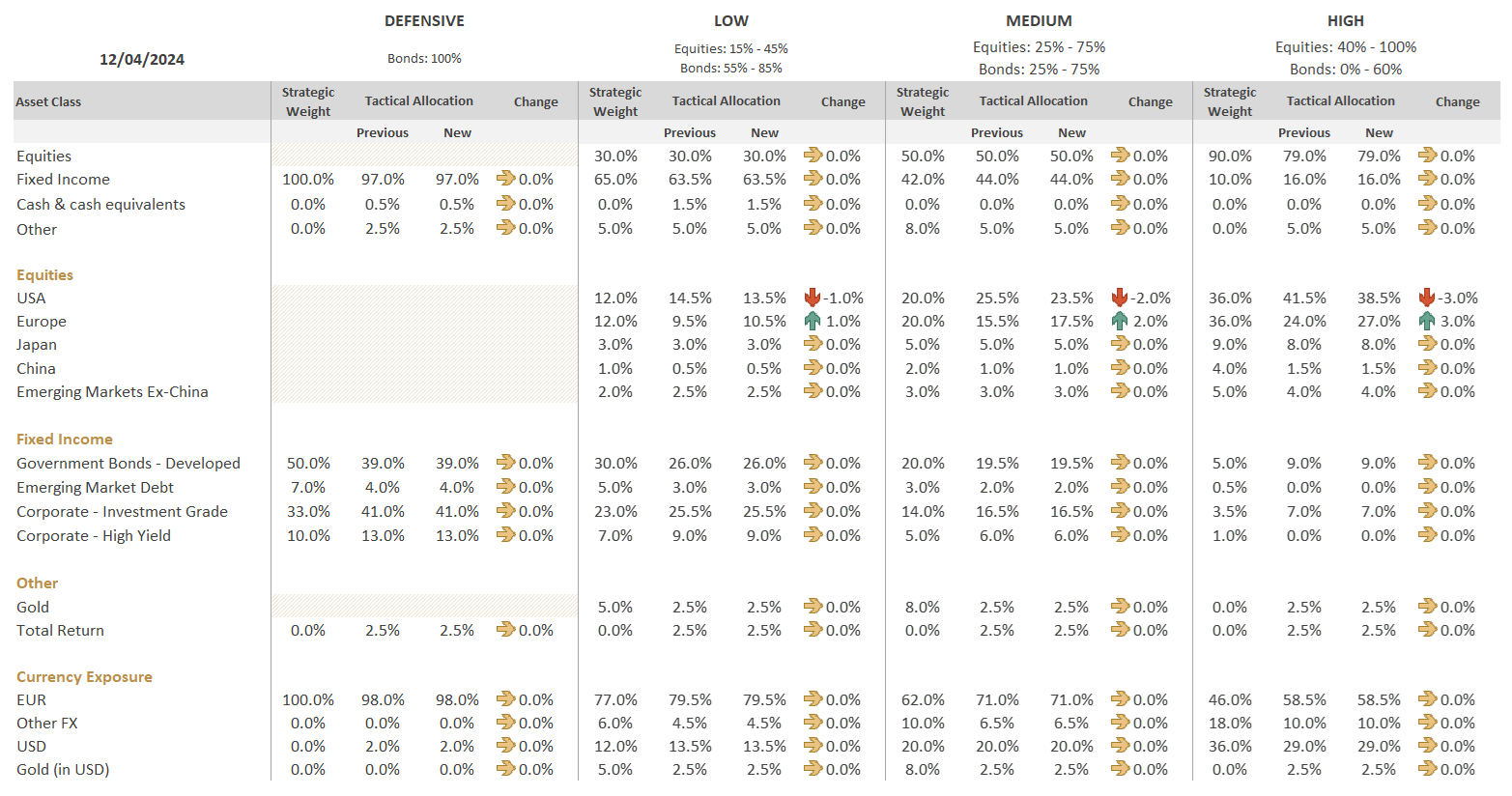

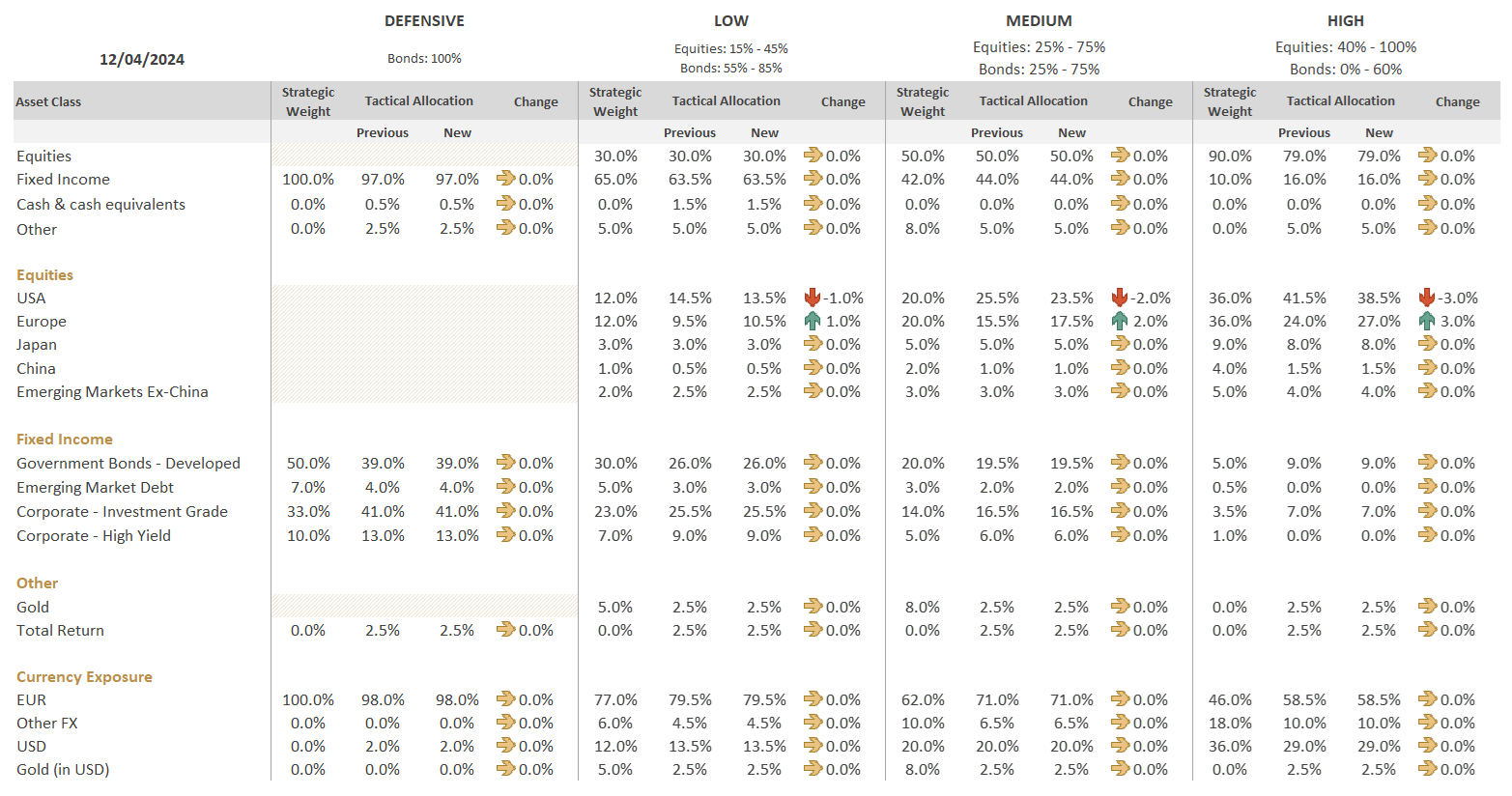

Asset Allocation Matrix

Please note that we have also increased the strategic equity weight in High risk profiles to 90%, from 70%. The strategic bond weight was reduced to 10%.

The strategic weight is used as an anchor over time, upon which we base our tactical decisions (overweight refers to having more of a certain asset class relative to the strategic weight defined for said asset class).

The implementation of this decision will be done in a timely manner, in line with the decisions of the Committee and with consideration of market conditions.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...