Choose Language

BILBoard November 2020 – A hint of value

Much has

changed since our last BILBoard note. The Democratic candidate, Joe Biden, won

the US presidential election, but the “blue wave” that markets had anticipated

did not materialise. Despite being caught wrong-footed, they quickly adopted

the opinion that a divided Congress was in fact the most palatable scenario to

prevent policy veering too far to the left. November also brought hope on the

vaccine front with two candidates delivering efficacy rates of around 95% in

trials. There’s a long way to go until the eventual distribution of any

vaccine, but heady sentiment sent the S&P 500 and the Dow Jones to new

all-time highs, and acted as a catalyst for a brief but violent rotation from

growth into value. However, optimism about the future and a solution to the

health crisis must be balanced against the reality of the here and now, with soaring

infection levels on both sides of the Atlantic inciting new restrictive measures.

Macro

The

epidemiological situation is showing up in the macro data, but not to the

extent that we need to adjust our base case. Thanks to monetary and fiscal

support, we still believe that an economic recovery through 2021 is on the menu,

with the wealth lost during the crisis recuperated in 2022.

In the US,

the recovery has been stronger than expected. On the corporate side, rising

industrial output, capacity utilisation and durable goods orders all point to a

pick-up, while the ISM survey indicates that both manufacturing and services

are in expansionary territory. This bodes well for the labour market and already

in October, the unemployment rate fell by a full percentage point to 6.9%.

Despite this, consumer sentiment has been dampened by rising case numbers. An extra helping of fiscal stimulus is due, but it is just hoped

that President Trump’s last months in the Oval Office go past without any show stoppers.

In Europe, third quarter GDP growth jumped more than expected (+12.7%), thanks to the removal of movement restrictions. But said restrictions are now being rolled out again, leaving the continent teetering on the edge of a double-dip scenario. It does not help that the much-awaited fiscal stimulus package is on the backburner after being blocked by Hungary and Poland, leaving the ECB in the driving seat when it comes to supporting the economy for now. The central bank is expected to expand measures at its December meeting but ultimately, there is little they can do to embolden consumers apart from alleviating the pressure of existing debt. In this area, there is a clear need for fiscal support.

The Chinese

economy is enjoying a clear V-shaped bounce-back, expanding 4.9% in Q3 due to a

faster than expected recovery in exports and retail sales. Both the

manufacturing and service sectors showed strong growth in October, and PMI data

points to continued expansion, helped by targeted fiscal support.

Fixed Income

The vaccine

breakthrough pushed rates higher, but increases are tempered by central bank

largesse, as well as concerns over mounting COVID-19 cases. The hunt for yield

is on again, and with $16 trillion of debt offering negative yields, investors

are venturing down the quality curve in search of income. It is crucial for

investors to remain selective in order to successfully navigate the risk/return

trade-off.

In the sovereign space, risk-free rates in the US are slowly rising with the economy showing dynamism, while European yields have retreated as the continent battles with its old demons of low growth and no inflation. Low and negative yields make govies the proverbial Brussels sprouts of a balanced portfolio, standard fare but not very appetizing. We are particularly cautious on duration in the US where there is the potential for a slow uptick in yields.

We continue

to prefer investment grade (IG) corporate bonds which are supported by

improving fundamentals. After months of sideways trading, vaccine news allowed

spreads to break through previous resistance levels, even falling below the 100

bps level in Europe. The IG market is supported by central banks for the time

being, and in Europe this is likely to persist into 2021. In the US, the IG bond

market is already standing on its own two feet, with the Fed only using a

fraction of its firepower. When it became apparent that the Fed will not continue

with corporate bond purchases in 2021, markets reacted calmly: corporates will

of course still receive indirect support from the Fed’s purchases in the

Treasury space.

High-yield

bonds have also broken through resistance levels and the yield on the US HY segment

hit an all-time low of 4.56% this month. With flows strong, default levels remaining

contained and the potential for some spread compression (predominantly between

BBB and BB), we are taking a selective approach to this asset class. The HY

buffet has a wide variety of companies—some are decent, whereas others are a

no-go area. Careful selection is key, especially with Moody’s forecasting that

defaults will not peak until March.

We continue

to favour emerging market corporate bonds over emerging market sovereigns due

to their volatility profile and shorter duration characteristics.

Equities

Overall, we

are positive on equities. On the heels of the Q3 earnings season, which was

much better than analysts had feared in both the US and Europe, analyst

revisions for earnings growth over the next 12 months have been turning

positivein all regions except Japan. We still prefer the US (home of

quality growth names and stay-at-home beneficiaries) and China (due to strong

domestic growth).

The scenario of interest rates remaining lower for

longer still favours the quality/growth style, and this remains our preference.

However, as we witnessed in November, relief rallies often come hand-in-hand

with short-lived but violent style rotations. While we do not believe that the

current environment is conducive to the prolonged outperformance of value

stocks, portfolios require protection against any temporary shifts in sentiment

that may arise. In order to achieve this, we have introduced some cyclicality

via our sector bets, primarily by reducing exposure to Consumer Staples in

favour of Industrials.

Industrials is a mid-to-late cycle sector that offers

a play on rising PMIs. It will be a key beneficiary of large-scale fiscal

stimulus programmes in both the US and Europe. We have also become more

positive on Materials. China’s recovery and a pick-up in industrial

activity are among the factors driving the sector’s strong earnings revisions,

as well as rises in commodity prices. While the sector looks expensive at first

glance, this is largely due to high valuations in the Chemicals subsector, and

value can still be found elsewhere.

While the above sectors bring a flavour of value, we balance this with strong growth sectors which we believe still have room to run, especially while the pandemic remains rampant. These safer plays are: IT, a sector with resilient earnings growth, strong cash flow generation and healthy balance sheets that benefits from both the stay-at-home theme and the structural shift towards digitalisation; Healthcare, a defensive sector that has gained impetus from the pandemic; and Utilities,another defensive sector that is benefitting—and will continue to benefit—from the global focus on renewables and clean energy.

...

It is not yet time to position portfolios for a value renaissance. However, as the economic recovery progresses, stocks that do not have the pizzazz of tech highflyers could start to make a comeback—especially when new fiscal stimulus packages begin to percolate through into the real economy next year. For the time being, we keep a main course of quality/ growth stocks, accompanied by a small helping of value stocks as some kind of amuse-bouche that will help investors stomach any temporary style rotations.

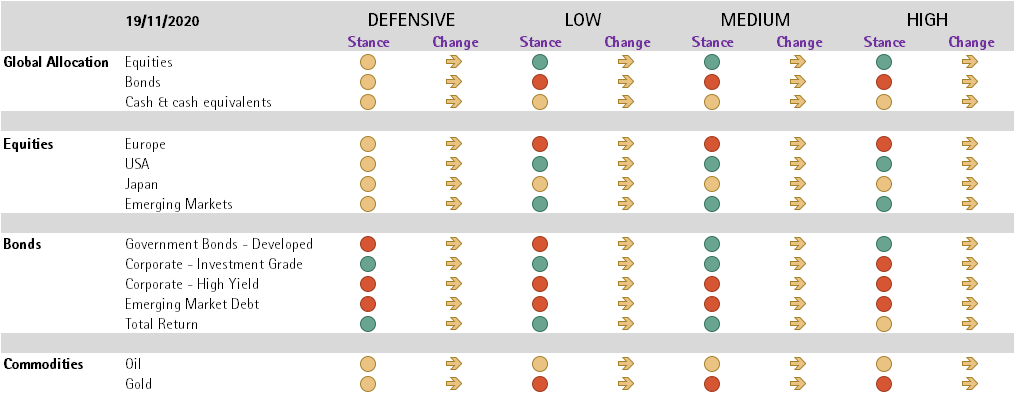

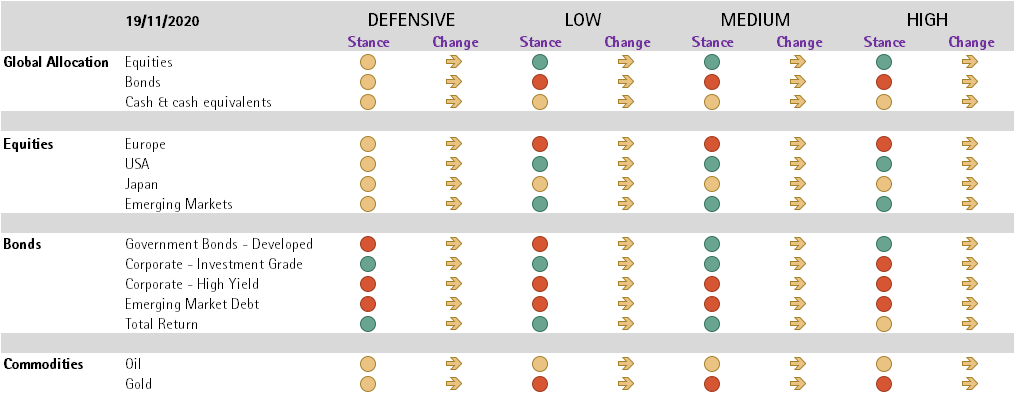

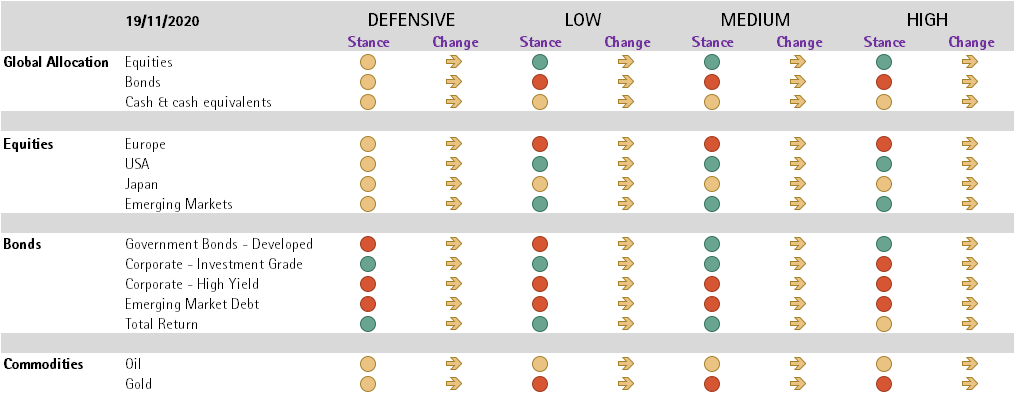

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...