Choose Language

November 2, 2020

BilboardBILBoard October 2020 – Weathering the pandemic

Overall, as the world emerges more quickly

than anticipated from one of the worst recessions on record, growth forecasts

have improved; the IMF now expects the global economy to experience a 4.4%

contraction in 2020, 0.8% better than predicted in June. This is largely thanks

to floods of fiscal and monetary stimulus and the containment of the virus in

China and other Asian countries. However, a Corona-shaped cloud still hangs

over the economy, threatening to rain on the recovery, undermining confidence,

consumption and investment. Some countries are better equipped to weather the

virus than others (from both a medical and policy standpoint) and, as such, a

very uneven recovery is playing out.

In the US, despite three million active

cases of the virus, stabilization is at play thanks to the Treasury and the

Federal Reserve. Business confidence is improving and factory activity rose for

four consecutive months before September’s moderation of -0.6% (which shows it

may be difficult to keep pace while the virus persists). On the consumer side,

sentiment increased in October, retail sales are stronger than they were before

the pandemic (concentrated online, in supermarkets and at building material

stores) and the real estate market is particularly buoyant. However, continued

confidence somewhat hinges on new fiscal stimulus to further support the

economy and the labour market. While the unemployment rate has fallen to 7.9%, long-term

unemployed (unemployed for 27 weeks or more) figures are creeping up, most recently

by 781,000 to 2.4 million, and labour market slack has weakened employee bargaining

power when it comes to wages. Inflation is still on the rise, reflecting an

improving economic situation, however we haven’t seen a risk of a sudden spike

that would instigate a policy pivot from the Fed (especially under its new

average inflation targeting). The elections are generating some anxiety and may

give rise to short-term volatility (especially if the outcome is disputed), but

ultimately, economic cycles are much more important for asset classes than the

composition of the US Government. In terms of the currency, we believe the

picture less supportive for the US dollar due to the cumbersome twin deficits

which could expand further if we see a Democratic sweep in the elections.

In the eurozone, the IMF expects a

contraction of -10.2%. Indeed, more rain could be on the forecast, as we wait

for datapoints showing how consumer behavior has been affected by the second

round of lockdowns and restrictions. Already, a loss of momentum in the industrial sector is clear,

and the pandemic has left a puddle on the labour market, with the unemployment rate on the rise since March (most recently 8.1%)

while inflation has all but evaporated (-0.3% in September), in part due to the

stronger euro.

In China,

with the virus almost snuffed out, the clouds have receded, making way for

economic sunlight. The country is an outlier in that it is expected to post positive

growth in 2020; the IMF predicts 1.9%, followed by 8.2% in 2021. Demand (external

and domestic) is coming back and China is now reshoring certain activities that

had been outsourced.

Other emerging markets are still in the thick fog of the pandemic. The IMF predicts growth of -8.1% in Latin America, as “the legacies of the pandemic cloud an already uncertain outlook”, while in India, for example, the economy is projected to contract by -10.3%. Oil exporting countries are at a particular disadvantage.

Fixed Income

We are maintaining our previous

allocations within the bond space, with a preference for high quality corporate

bonds in both developed markets and within our Emerging Market allocation.

While we’ve maintained a layer of governments

as a windbreaker in times of heightened volatility, we are generally reluctant

on this asset class, especially in the US and on longer duration. Polls suggest

that the Democrats could take victory in the US election. If they do, we could see

a much larger stimulus package (c. $2 trillion) than may have been expected

under Republican charge, which could in turn drive rates higher. As such “short

Treasuries” is now a consensus trade.

We like corporate bonds given the continued support of central banks. The ECB is expected to continue buying bonds at a pace of up to EUR 10 billion per month. Economists expect more stimulus to be announced in December 2020 and an extension of the emergency program to end-2021. In the US, the bond market is now standing on its own two feet and the Fed has been able to dial down its bond buying, using only a fraction of its firepower. Despite the fact that the Fed’s buying is mostly symbolic, if it doesn’t extend the program which is set to expire in December, there is a risk of volatility.

High-yield bonds have been trading sideways. In

Europe, default rates are low, while being slightly higher in the US (however 4/5

of defaults occurred in the beleaguered energy sector). We are selective on

this asset class, preferring companies that have not saddled themselves with

too much debt. In the emerging market debt space, corporates are still the most

attractive tranche.

Equities

Maintaining an overweight in the US and switching part of our European

exposure to China.

Despite

rising infection levels, US equity markets were stable up to the last week of

October and following September’s correction. The Q3 earnings season has been

better than feared (over 80% of companies on the S&P 500 have reported a

positive surprise), however is still on track to post the second worst set of

results since the 2008 financial crisis, and guidance remains opaque. The US has

strong prospects given that it is the region where the most prominent growth

and “stay at home” beneficiaries are located. It is admittedly expensive, with

hopes around new stimulus inflating valuations even further – so the challenge will be for companies to deliver on the earnings

front in 2021. The US is the only region to have a minor positive

revision amongst analysts, however this has started to level off as they grow a

little more sceptical – something we are paying close attention to, especially

as earnings results roll out.

With the eurozone underperforming on almost every

front, we have gone even more underweight, switching a proportion of our

holdings to Chinese equities. Accelerating

reforms in China are broadening access to foreign investors, lifting growth

prospects while sectors like technology, healthcare and consumption are driving

returns.

In

terms of style, “lower for longer” interest rate policies are supportive of

growth and quality stocks. In terms of sectors, we like healthcare, consumer

staples and IT, as well as some late cyclicals such as materials and utilities

which have enjoyed strong revisions. Due to wide-ranging dispersions in

performance, selectivity is key, and we still prefer to identify top performers

within sectors, rather than betting on sectors as a whole.

Commodities

Despite the short-term consolidation in

September, we are constructive on gold over the longer term. Bullion ETFs have

received record inflows and the price is on an uptrend – above its 100-day

moving average. Higher inflation expectations remain supportive.

We are negative on oil. Even though demand

has picked up recently, driven by China, it will likely come under pressure

again as governments unveil new restrictions on activity. The second round of lockdowns

has also limited OPEC’s flexibility to loosen supply, as it planned to do in

January 2021.

Conclusion

In Japan there are fifty different words to describe rain. There are just as many different rates of recovery playing out around the world, and we aim to position ourselves in locations that are faring best – namely the US and China. In the coming quarters, the trajectory of the economy will depend largely on countries’ ability to contain the virus, but come rain or shine, a well-diversified portfolio comprising high quality assets is the best way to weather the storm until blue skies return.

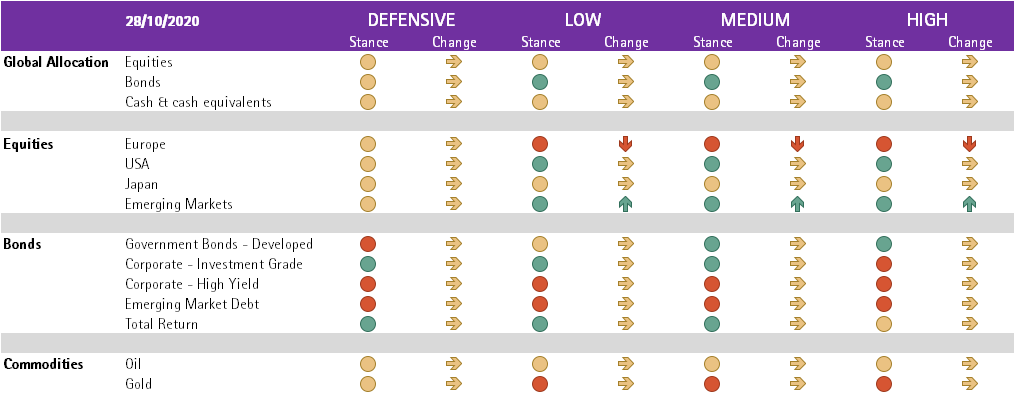

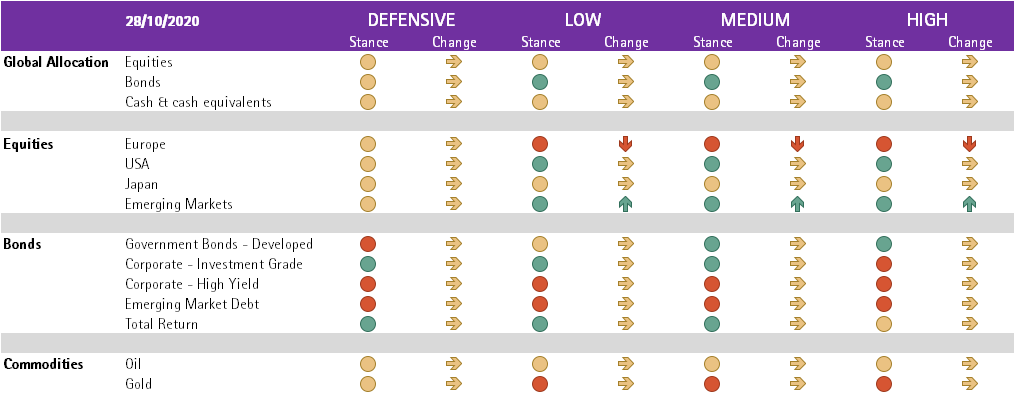

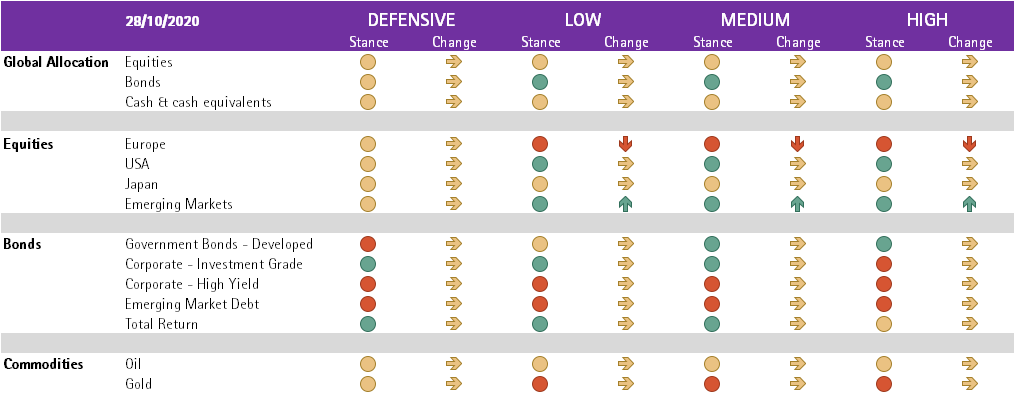

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...